This content originally appeared on HackerNoon and was authored by DeLeverage

Table of Links

3 Background

4 System Model and 4.1 System Participants

4.2 Leverage Staking with LSDs

7.1 stETH Price Deviation and Terra Crash

7.2 Cascading Liquidation and User Behaviors

8 Stress Testing

8.1 Motivation and 8.2 Simulation

9 Discussion and Future Research Directions

A. Aave Parameter Configuration

B. Generalized Formalization For Leverage Staking

C. Leverage Staking Detection Algorithm

6 Empirical Study

We outline the empirical evaluation of leverage staking across Aave, Lido and Curve.

\ Data Collection. We first crawl the on-chain events involving users’ actions on the Aave V2 lending pool, including deposit, borrow, withdraw, and repay events. For direct leverage staking, we crawl the historical stake (i.e, submitted) events related to Lido stETH Token when users stake ETH on Lido. For indirect leverage staking, we crawl the historical swap (i.e., TokenExchange) events for Curve stETH–ETH pool. We use an Ethereum Geth node on a Linux machine running Ubuntu 22.04 LTS, which is equipped with AMD 48-core CPU, 256 GB of RAM, and 12 × 2 TB SSD. We capture all the targeted events from block 11,473,216 (Dec 17, 2020) to block 17,866,191 (Aug 7, 2023), 963 days in total. We identify 290,984

\

\

\

\

\ stake events on Lido, 449,528 deposit, 238,388 borrow, 336,746 withdraw and 173,596 repay events on Aave V2 lending pool, and 105,310 swap events on Curve stETH–ETH pool.

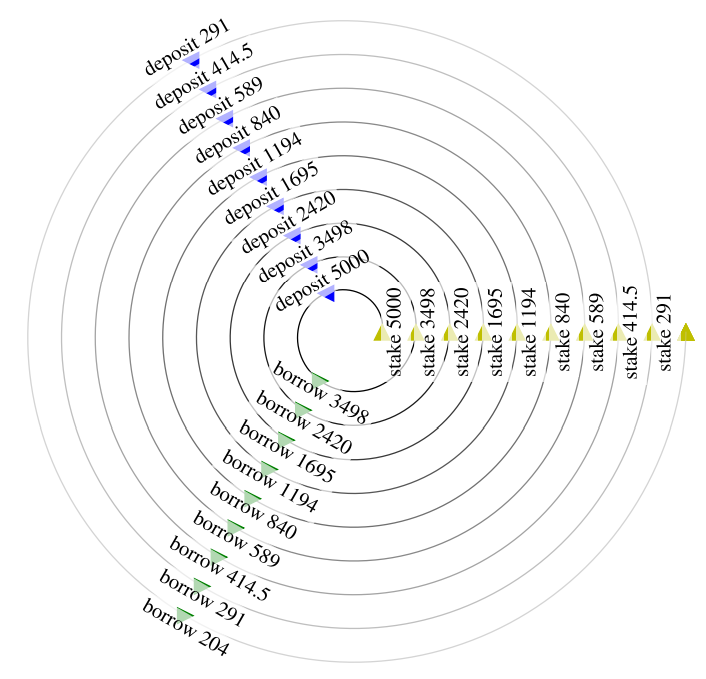

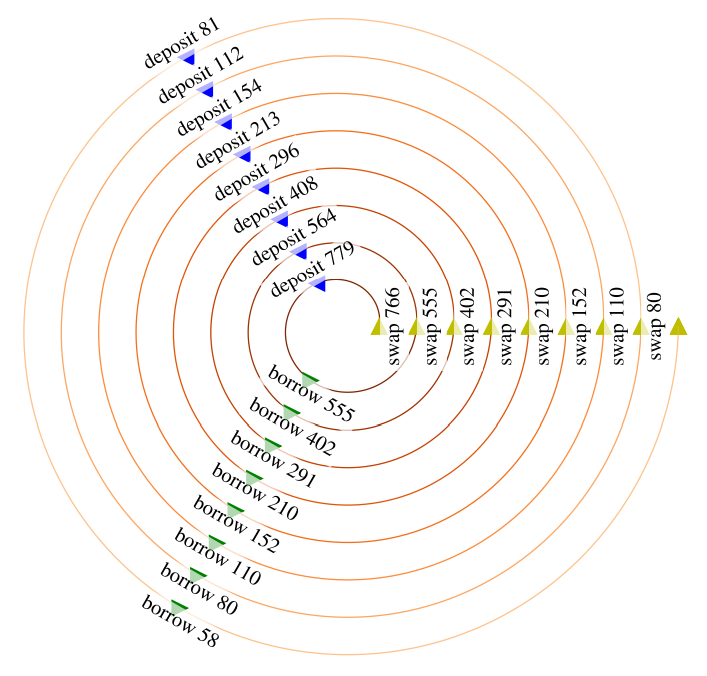

\ Leverage Staking Detection. We proceed to analyze the users who adopt the direct or indirect leverage staking strategy. From the 449,528 deposit and 238,388 borrow events on Aave V2, we find that 743 addresses are used to deposit stETH as collateral and then borrow ETH. We then propose Algorithm 1 and 2 (see Appendix C) to identify the addresses involving direct and indirect leverage staking respectively. Specifically, we extract the event sequences of (stake, deposit, borrow, stake) and (swap, deposit, borrow, swap) in chronological order, which follows the direct and indirect leverage staking process (Figure 4).

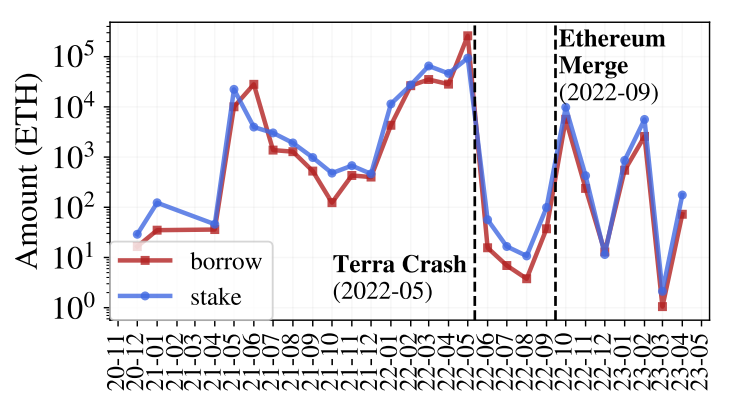

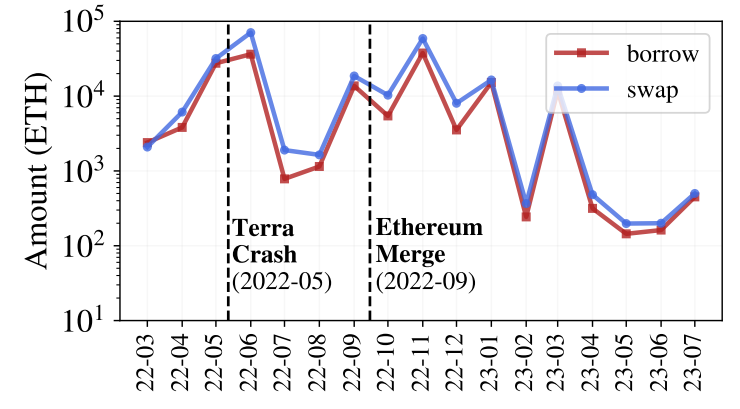

\ We have identified 262 addresses that have been engaging in direct leverage staking activities, with a cumulative stake amount of 295,243 ETH. In addition, we observe 180 addresses that have performed the indirect leverage staking strategy, with a cumulative swap amount of 241,880 ETH. The distribution of leverage stake and swap amount is depicted in Figure 7 and 8 respectively. Interestingly, we observe that the volume of both direct and indirect leverage staking was substantially impacted by the Terra crash in May 2022. The stake amount of direct leverage staking experienced a drastic decline from the peak monthly stake amount of 93,661 ETH in May 2022 to 11 ETH in Aug 2022. Similarly, the swap amount of indirect leverage staking declines from 70,655 ETH in Jun 2022 to 1,639 ETH in Aug 2022. Moreover, the Ethereum Merge brought about a resurgence in leverage staking activities, with a stake amount of 9,814 ETH and a swap amount of 10,293 ETH in Nov 2022.

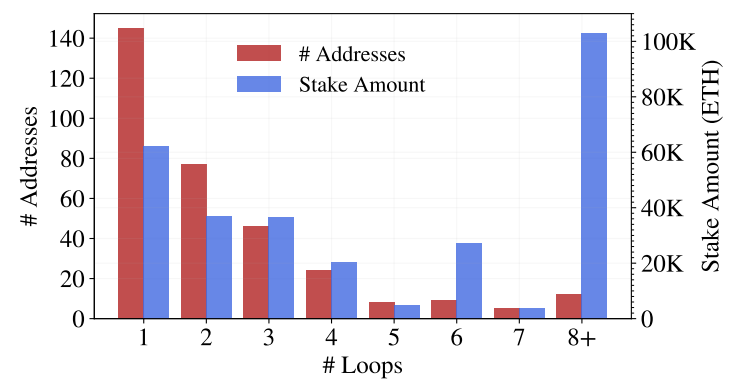

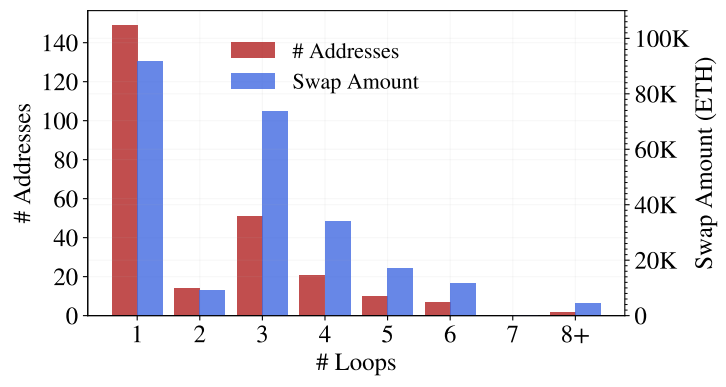

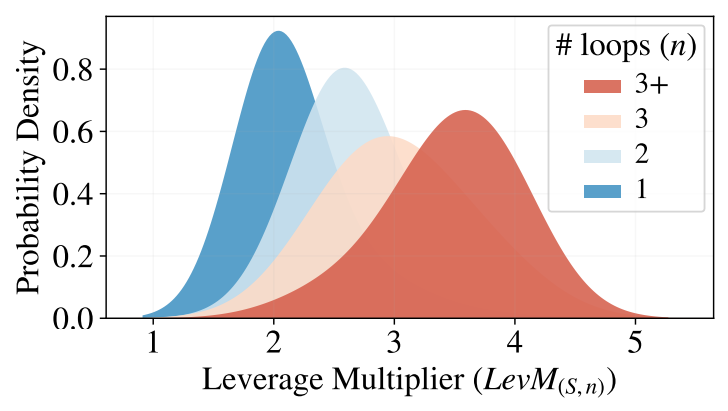

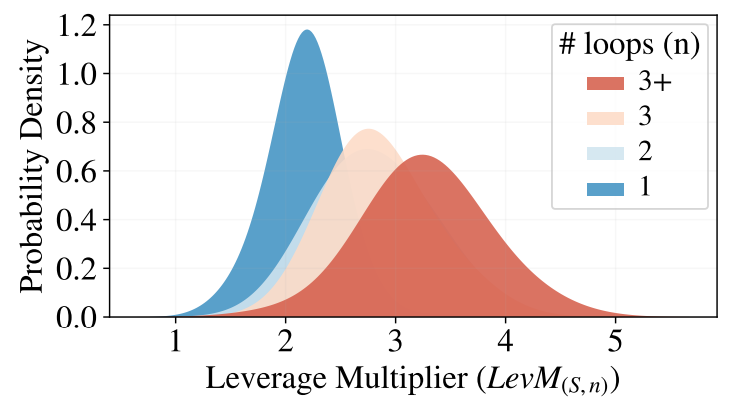

\ Leverage Staking Loops. Among 262 and 180 addresses that have adopted direct and indirect leverage staking, we conduct an analysis focusing on two key elements: the number of loops (denoted as n) and the leverage multiplier (denoted as LevM(S,n) ), derived from their extracted action sequence Es (see Algorithm 1 and 2). To calculate the number of direct

\

\

\

\

\ and indirect leverage staking loops, we identify consecutive sub-sequences in Es consisting of (stake, deposit, borrow) and (swap, deposit, borrow) respectively. Figure 9 reveals that 145 addresses (55.35%) performed direct leverage staking with a single loop (n = 1), while Figure 10 shows that 149 addresses (82.78%) performed indirect leverage staking with a single loop. Notably, we discover that although only a smaller subset of 12 addresses performs direct leverage staking with more than eight loops, their cumulative staking activities amount to a significant volume of 102,998 ETH. This highlights a concentrated yet substantial engagement in direct leverage staking. In contrast, only 2 addresses performed indirect leverage staking with more than eight loops, with a total swap amount of 4,669 ETH. The difference in the number of participants and the total amount staked suggests distinct participant profiles and strategies between direct and indirect leverage staking. The comparison indicates that direct leverage staking is more likely to attract sophisticated market participants who are willing to perform more loops with substantial capital commitments.

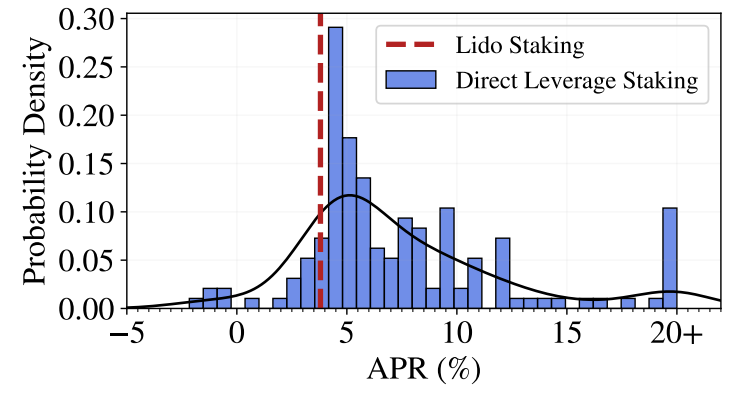

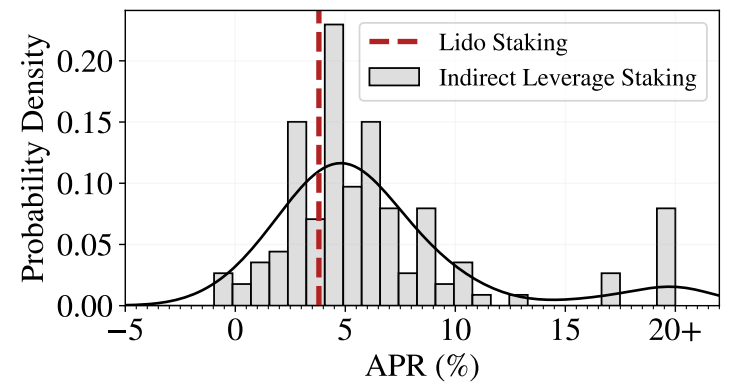

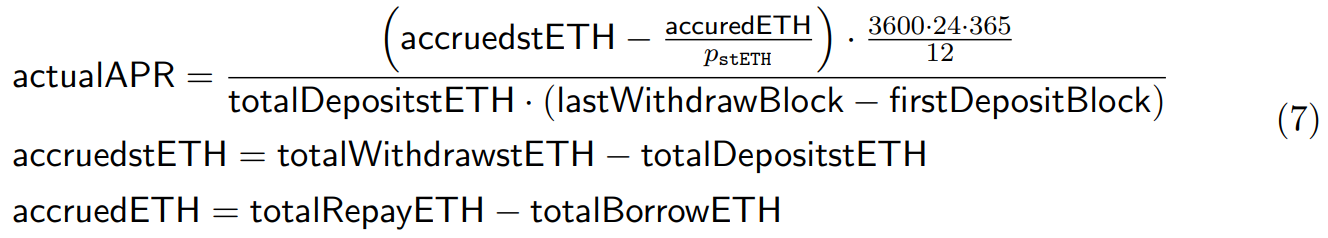

\ Leverage Staking APR. We focus on a subset of 152 and 137 direct and indirect leverage staking addresses that have successfully repaid their debts and withdrawn their collateral from Aave stETH–ETH positions. To calculate their actual APR, as outlined in Equation 7, we consider the net earnings from deposit and withdraw actions, balanced against the ETH

\

\

\ accrued through borrow and repay actions. Additionally, we account for the conversion of accrued ETH to stETH, factoring in the stETH price at the time of the last withdraw action.

\

\ The distributions of direct and indirect leverage staking APR are visually depicted in Figure 13 and 14 respectively. Notably, our findings reveal that a significant majority (81.7%), precisely 137 (90.13%) direct and 99 (73.33%) indirect leverage staking addresses, have realized an APR higher than the APR of conventional staking on Lido.

\ Leverage Staking Examples. We present two examples to enhance the understanding of leverage staking. From block 14,617,906 to 14,627,202, a whale wallet address 0xD2…701 executed the direct leverage staking strategy with 9 loops. The recursive action sequences of (stake, deposit, borrow, stake) are shown in Figure 15. 0xD2…701 invested a principal amount of 5,000 ETH. The direct leverage staking results in a total investment amount of 16,145.5 ETH. This led to a leverage multiplier of 3.23, demonstrating the amplification effect of the leverage strategy. In another instance, from block 16,031,087 to 16,031,208, 0xA1…882 performed the indirect leverage staking strategy. This was accomplished by recursively executing the action sequence of (swap, deposit, borrow, swap). 0xA1…882 started with a principal investment amount of 766 ETH. Through 8 leverage loops, 0xA1…882 achieved a total investment of 2,624 ETH, resulting in a leverage multiplier of 3.43. This illustrates the effectiveness of the indirect leverage staking strategy in increasing the total investment.

\

:::info Authors:

(1) Xihan Xiong, Imperial College London, UK;

(2) Zhipeng Wang, Imperial College London, UK;

(3) Xi Chen, University of Sussex, UK;

(4) William Knottenbelt, Imperial College London, UK;

(5) Michael Huth, Imperial College London, UK.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

This content originally appeared on HackerNoon and was authored by DeLeverage

DeLeverage | Sciencx (2025-07-08T05:18:58+00:00) How Ethereum Whales Use Loops to Leverage Stake Millions in ETH. Retrieved from https://www.scien.cx/2025/07/08/how-ethereum-whales-use-loops-to-leverage-stake-millions-in-eth/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.