This content originally appeared on HackerNoon and was authored by DeLeverage

Table of Links

3 Background

4 System Model and 4.1 System Participants

4.2 Leverage Staking with LSDs

7.1 stETH Price Deviation and Terra Crash

7.2 Cascading Liquidation and User Behaviors

8 Stress Testing

8.1 Motivation and 8.2 Simulation

9 Discussion and Future Research Directions

A. Aave Parameter Configuration

B. Generalized Formalization For Leverage Staking

C. Leverage Staking Detection Algorithm

3.3 Staking Options

Ethereum participants are presented with four distinct staking options as follows.

\ Solo Staking. In solo staking, individual participants operate their validator nodes by committing a threshold of 32 ETH, thus maintaining full control over the staking rewards. However, solo staking necessitates technical expertise to manage a validator node. Furthermore, its substantial capital requirement may render it financially inaccessible for many retail users.

\ Staking as a Service (SaaS). For users possessing the requisite 32 ETH but lacking in technical expertise, SaaS presents a viable solution. SaaS manages the validator node on behalf of the user, utilizing their signing keys to perform on-chain tasks[4]. This simplifies the staking process for individuals and mitigates the risks associated with node management.

\ Pooled Staking. For retail users with holdings below the 32 ETH threshold, pooled staking emerges as a feasible alternative, enabling them to collectively participate in the network’s validation process, earn rewards, and capitalize on the broader Ethereum ecosystem without the need for individual, full-node commitments. Typically, staking pools charge fees, which are further split between Node Operators (NOs) and the protocol Decentralized Autonomous Organization (DAO). NOs run and maintain validator nodes on behalf of the staking pool, while the DAO selects NOs and configures crucial parameters for the protocol.

\ Centralized Exchange (CEX) Staking. CEXs, such as Coinbase and Binance, provide centralized and custodial staking services to users. These services simplify the staking process by managing technical aspects and providing a user-friendly interface. However, such convenience comes with inherent risks associated with the centralized nature of CEX staking. Users must trust these platforms with their assets, making them vulnerable to security breaches, regulatory changes, or operational failures.

3.4 LSD

\

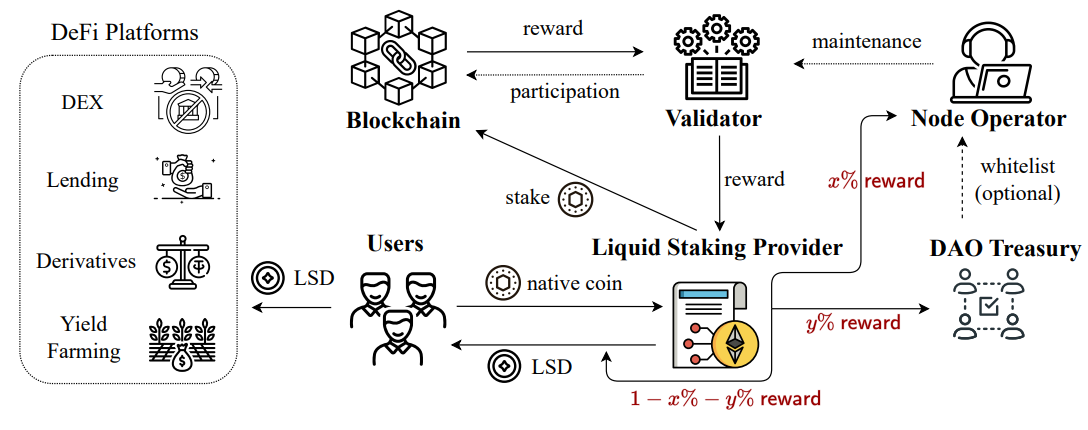

\ \ Staking offers several advantages, from earning rewards to enhancing network security. However, once ETH is locked for staking, it becomes illiquid, making it inaccessible for trading. Given this challenge, the concept of LSD emerged, which represents staked assets and rewards in a tradable form. Figure 1 provides an overview of the LSD ecosystem. When users stake ETH within an LSD provider (e.g., a liquid staking pool), they receive LSDs in return.

\ At the time of writing, liquid staking protocols accumulate a TVL of more than 53.3b USD, securing the top position in TVL across various DeFi sectors. Users can obtain LSDs through two primary staking methods: pooled staking and CEX staking. Pooled staking protocols such as Lido, Rocket Pool, Frax, Stakewise, and Swell Network provide LSDs to users. CEXs such as Coinbase and Binance also support LSDs.

\ Lido is currently the leading LSD provider and ranks as the largest DeFi protocol in terms of TVL (40b USD). Users stake ETH on Lido to receive stETH in return. With over 430k stakers, the total amount of ETH staked on Lido reached 9.76m in Mar 2024, accounting for 71% of the total ETH LSDs. stETH implements the rebasing mechanism, where stETH holders’ account balances get adjusted daily to reflect the accumulated rewards [26]. The rebase can be positive or negative, depending on the validators’ performance.

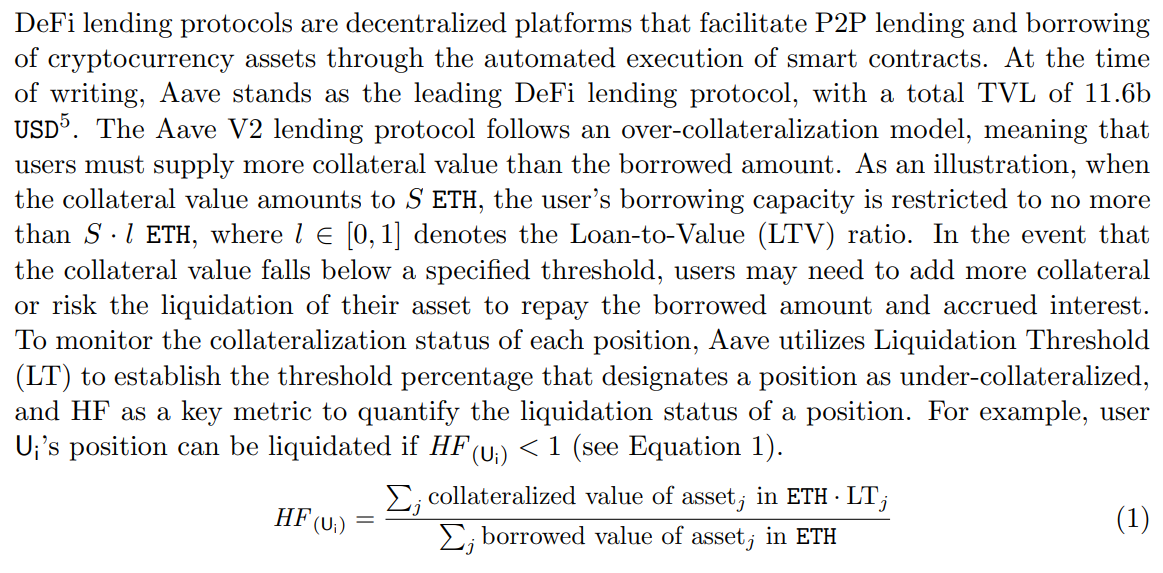

3.5 DeFi Lending Protocols

\

\ \

:::info Authors:

(1) Xihan Xiong, Imperial College London, UK;

(2) Zhipeng Wang, Imperial College London, UK;

(3) Xi Chen, University of Sussex, UK;

(4) William Knottenbelt, Imperial College London, UK;

(5) Michael Huth, Imperial College London, UK.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

[4] https://ethereum.org/en/staking/saas/

This content originally appeared on HackerNoon and was authored by DeLeverage

DeLeverage | Sciencx (2025-07-08T05:18:37+00:00) How to Stake ETH and Earn Rewards Without Locking Your Funds. Retrieved from https://www.scien.cx/2025/07/08/how-to-stake-eth-and-earn-rewards-without-locking-your-funds/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.