This content originally appeared on HackerNoon and was authored by Obyte

\ When something big happens in the world (a war, a pandemic, a banking collapse) money starts moving fast. People panic, hedge, pull out, or double down. Traditional markets have been through this dance many times. Crypto, still relatively new on the global stage, reacts to the crisis too. But not always in ways you’d expect.

Sometimes it crashes right alongside everything else. Other times, it rallies while stocks fall. And once in a while, it becomes a lifeline for people cut off from banks or facing currency collapse. If you're wondering whether crypto helps or hurts during major crises (also known as black swans), the answer is: it depends. It depends on the event, the region, the asset, and how people choose to use it.

Let’s look at how different types of global crises affect digital assets, and what we can learn about the long-term strength of these technologies.

Economic Turmoil: Flight to Safety or Risk-Off Panic?

If traditional markets wobble, people tend to look for something stable. Gold has been the go-to asset for centuries. Bitcoin, often called “digital gold,” is trying to earn that same reputation. But it’s not always that simple.

Take the 2023 U.S. banking scare, when Silicon Valley Bank and Signature Bank collapsed. While stocks dipped, Bitcoin jumped in value, with investors treating it as a hedge against traditional finance. That looked like a big vote of confidence in crypto.

But rewind to early 2020, and it’s a different story. At the start of the pandemic, people rushed to cash. Bitcoin dropped hard. It wasn’t seen as a safe haven then, at least not immediately. What followed was a remarkable rebound. BTC went from under $5,000 in March to over $60,000 a year later. The whole coin market capitalization followed these movements closely.

So why the mixed signals? The truth is, crypto is still finding its role. When inflation is high and central banks like the Federal Reserve raise interest rates, investors often shy away from risky assets. That can hit crypto just like tech stocks. But over time, confidence grows, and digital assets tend to bounce back faster than most expect.

In Political Unrest and Censorship

In places where political turmoil is a daily reality, crypto sometimes becomes more than just an investment. It becomes a lifeline.

Look at Ukraine during the early days of the Russian invasion. As traditional systems broke down, crypto donations poured in from all over the world, helping fund everything from aid to defense. People used stablecoins to preserve savings when their currency lost value overnight. Some others were able to preserve and exchange their funds for themselves, given that the banks and ATMs weren’t working properly.

https://www.youtube.com/watch?v=deLrO7Rj6XU&embedable=true

The same thing happened in Venezuela, where years of hyperinflation pushed many to turn to crypto for daily purchases or savings. In Nigeria, despite government efforts to ban crypto, peer-to-peer transactions kept growing. People found ways around restrictions, often using tools like decentralized exchanges or crypto wallets that don’t rely on banks or middlemen.

But crypto (or at least, not all of them) isn’t invincible. In 2022, the U.S. Treasury sanctioned Tornado Cash, a privacy-focused tool on Ethereum. Many Ethereum validators began censoring blocks to comply with those sanctions. That event made waves, sparking debates about how decentralized Ethereum really is.

So, while crypto can offer a way around censorship and control, not all projects are equally resistant. It all comes down to how they’re built.

Crypto Resilience in the Long Run

Here’s the tough part: not every crypto project makes it through hard times. Some rely too much on hype, or on centralized teams who disappear the moment things go south. Others buckle when regulators apply pressure or when communities lose trust.

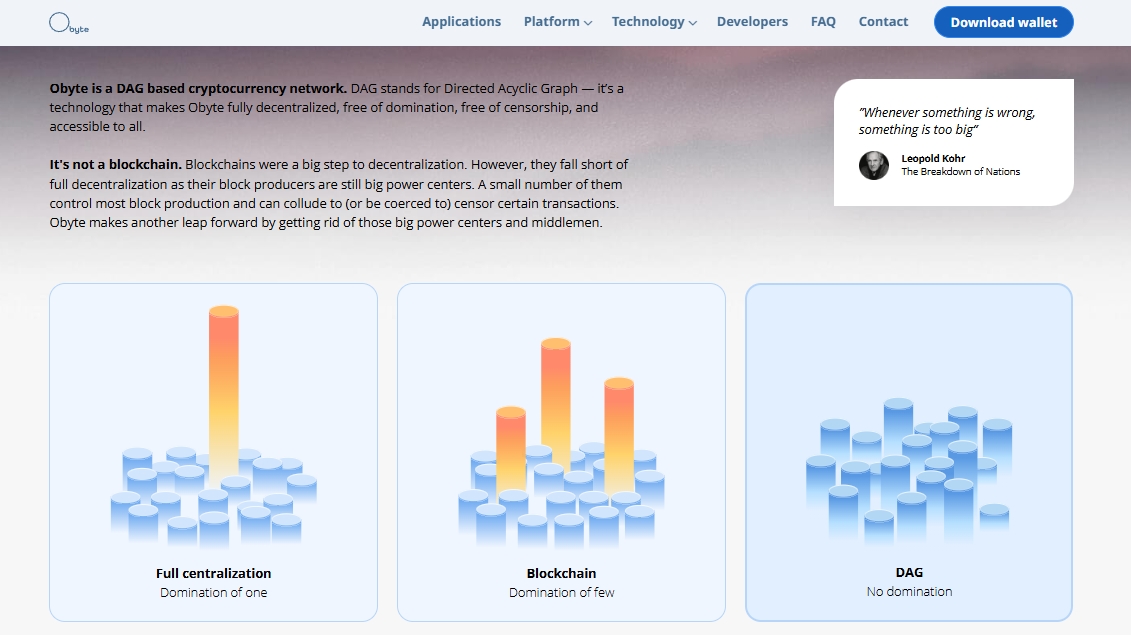

But there are coins and platforms that quietly keep going, against all odds, because they’re built for endurance. A good example is Obyte, a platform that runs on a DAG (Directed Acyclic Graph), which means it doesn’t depend on miners or “validators” —no middlemen to approve or disapprove transactions. There’s no mining, no energy-hungry process, and no single point where governments can apply pressure to halt certain activity.

That kind of design makes it easier to keep functioning even when the environment gets hostile or unstable. In places with poor infrastructure, limited access to banking, or political interference, systems like this can keep running smoothly.

What we’ve learned from crisis after crisis is that resilience matters. Not just in price, but in structure. The cryptos that stand tall are often the ones built quietly and thoughtfully, with communities that believe in their long-term mission.

So, next time the world shakes, and markets go red, remember this: not all coins react the same. And in the end, the ones that survive might not be the loudest or flashiest. They’re the ones prepared for the storm.

\

Featured Vector Image by Freepik

\n

This content originally appeared on HackerNoon and was authored by Obyte

Obyte | Sciencx (2025-07-31T07:24:42+00:00) Crypto in Times of Crisis: How Global Events Affect Digital Assets. Retrieved from https://www.scien.cx/2025/07/31/crypto-in-times-of-crisis-how-global-events-affect-digital-assets/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.