This content originally appeared on HackerNoon and was authored by Market Crash

Table of Links

III. TDA Approach to analyzing multiple time series

A. Obtaining point cloud from stock price time-series

B. EE due to the 2008 Financial crisis

C. EE due to COVID-19 pandemic

D. Impact of COVID-19 on different Indian sectors

VII. Acknowledgments and References

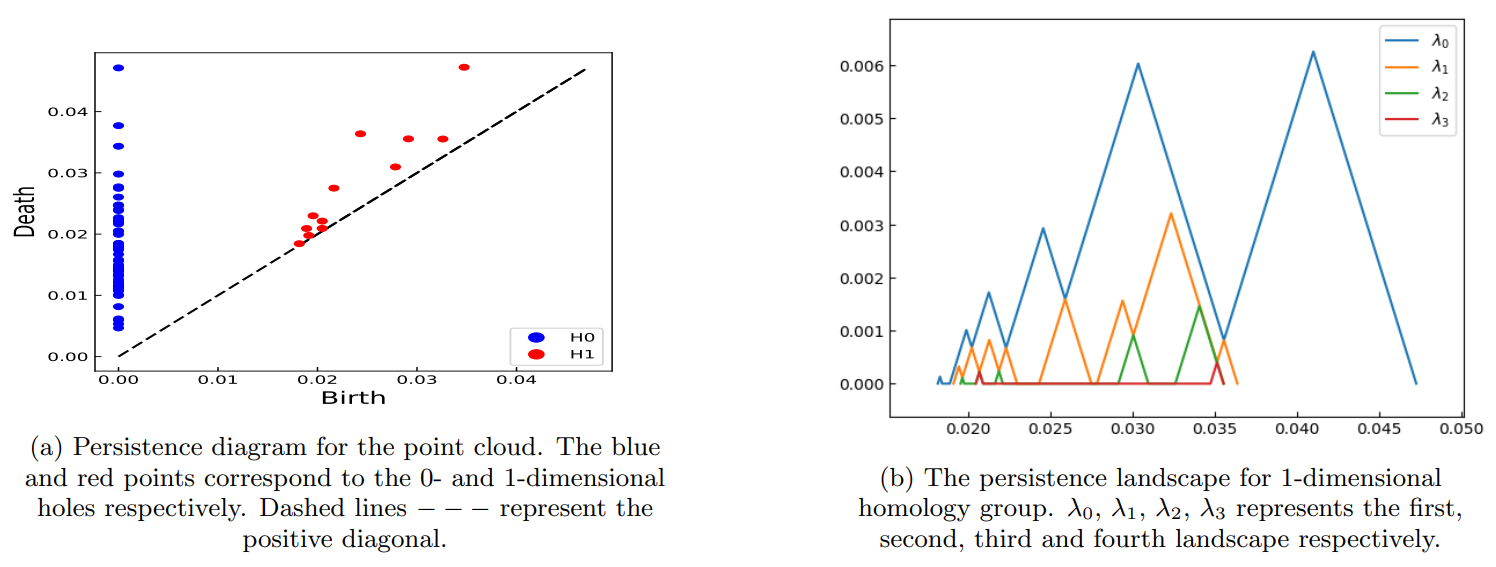

V. RESULTS AND DISCUSSION

This section shows the result of the identification of continent-wise extreme events (EEs) during the 2008 financial crisis and the COVID-19 pandemic using TDA. It allows the identification of EEs from multiple stock time series at once. Also, a sector-wise impact of the COVID-19 pandemic is analyzed in the Indian stock market.

\

\

:::info Authors:

(1) Anish Rai, Department of Physics, National Institute of Technology Sikkim, Sikkim, India-737139;

(2) Buddha Nath Sharma, Department of Physics, National Institute of Technology Sikkim, Sikkim, India-737139;

(3) Salam Rabindrajit Luwang, Department of Physics, National Institute of Technology Sikkim, Sikkim, India-737139;

(4) Md.Nurujjaman, Department of Physics, National Institute of Technology Sikkim, Sikkim, India-737139;

(5) Sushovan Majhi, Data Science Program, George Washington University, USA, 20052.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

This content originally appeared on HackerNoon and was authored by Market Crash

Market Crash | Sciencx (2025-08-29T01:27:46+00:00) Global Financial Analysis: A TDA-Based Approach to Market Crashes. Retrieved from https://www.scien.cx/2025/08/29/global-financial-analysis-a-tda-based-approach-to-market-crashes/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.