This content originally appeared on HackerNoon and was authored by DeLeverage

Table of Links

3 Background

4 System Model and 4.1 System Participants

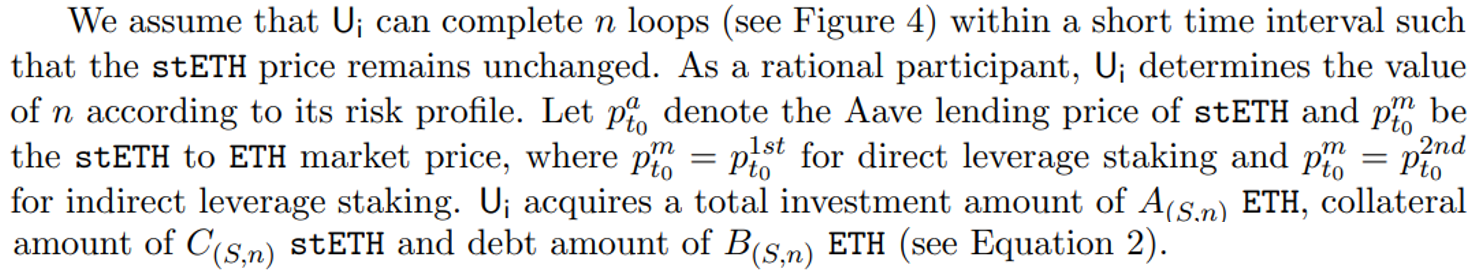

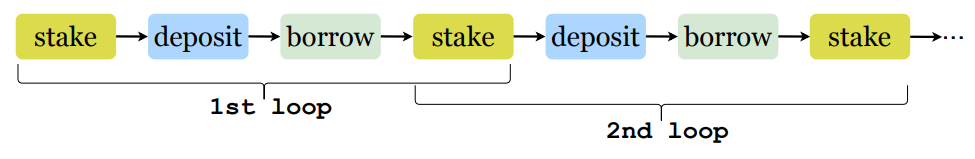

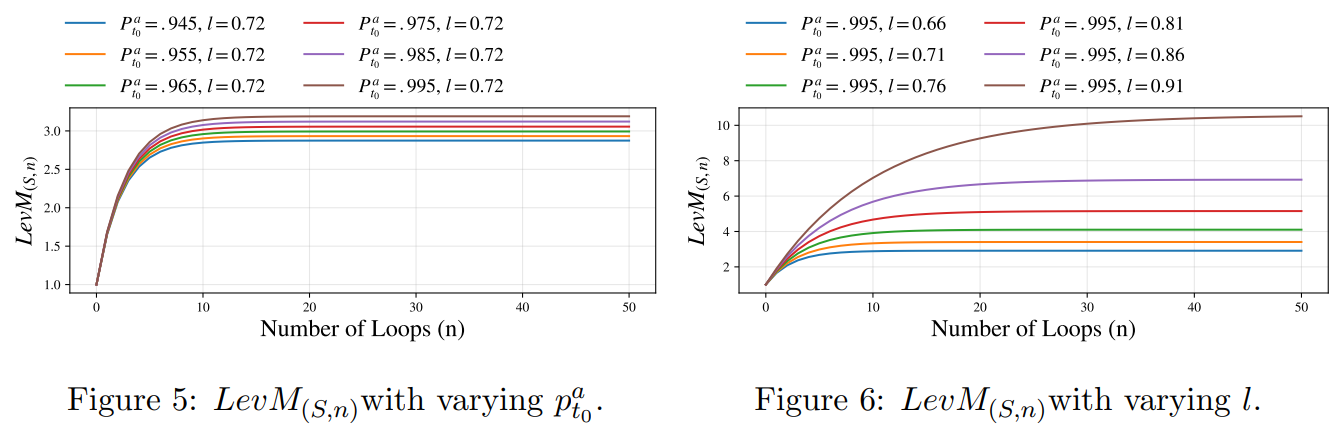

4.2 Leverage Staking with LSDs

7.1 stETH Price Deviation and Terra Crash

7.2 Cascading Liquidation and User Behaviors

8 Stress Testing

8.1 Motivation and 8.2 Simulation

9 Discussion and Future Research Directions

A. Aave Parameter Configuration

B. Generalized Formalization For Leverage Staking

C. Leverage Staking Detection Algorithm

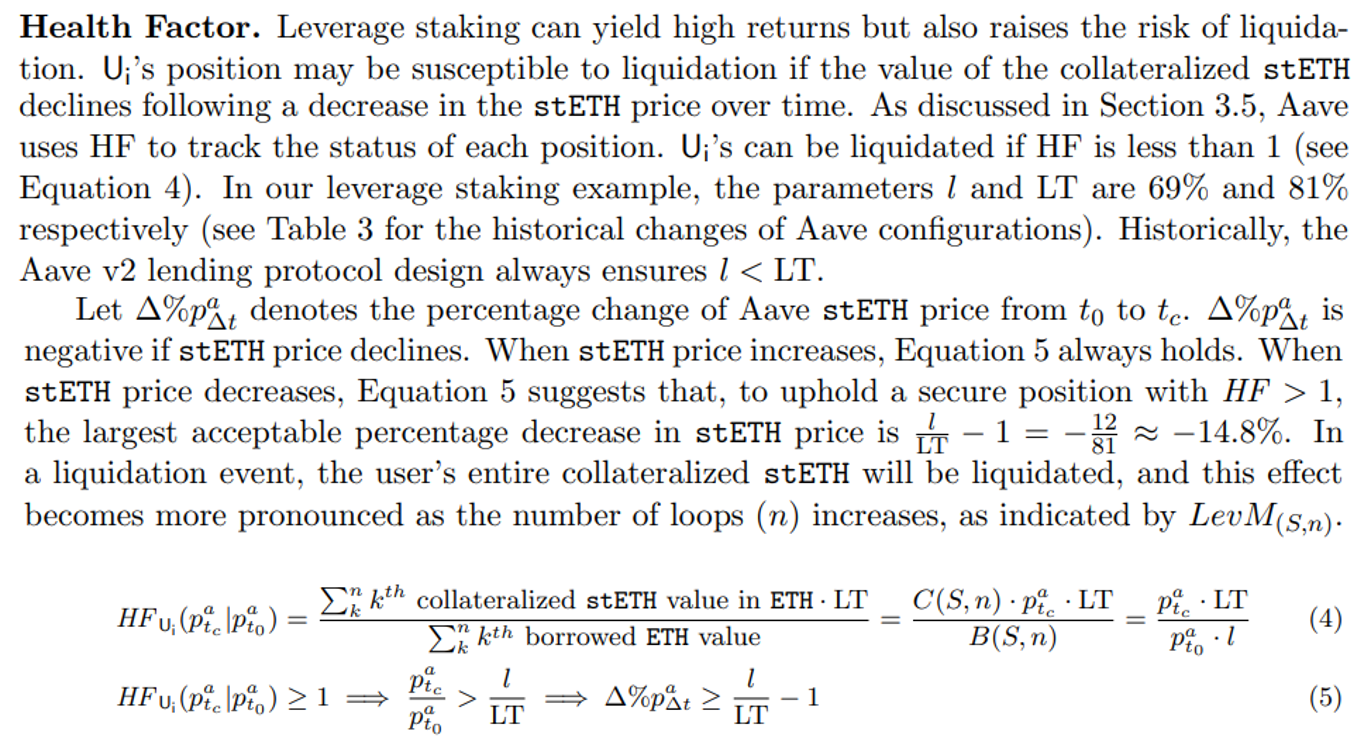

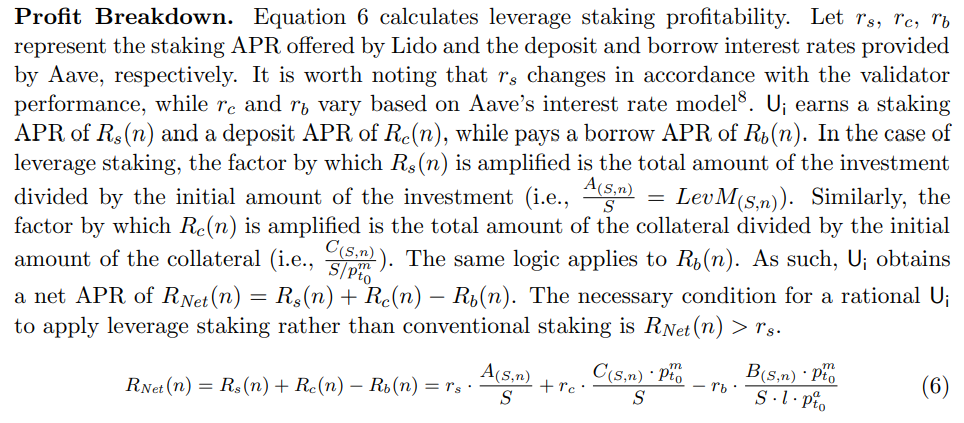

5 Analytical Study

This section conducts an analytical study on the leverage staking strategy. We also offer a generalized formalization encompassing other potential scenarios in Appendix B.

\

\

\

\

\

\

\ In addition to the standardized scenario discussed above, real-world applications of leverage staking can vary significantly among users. For instance, a user might choose not to reinvest all of their received stETH on Aave. For a more detailed exploration of this variability, please see the generalized formalization in Appendix B.

\

:::info Authors:

(1) Xihan Xiong, Imperial College London, UK;

(2) Zhipeng Wang, Imperial College London, UK;

(3) Xi Chen, University of Sussex, UK;

(4) William Knottenbelt, Imperial College London, UK;

(5) Michael Huth, Imperial College London, UK.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

[8] https://docs.aave.com/risk/liquidity-risk/borrow-interest-rate

This content originally appeared on HackerNoon and was authored by DeLeverage

DeLeverage | Sciencx (2025-07-08T05:18:50+00:00) The Risks and Realities of Leverage Staking. Retrieved from https://www.scien.cx/2025/07/08/the-risks-and-realities-of-leverage-staking/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.