This content originally appeared on HackerNoon and was authored by EScholar: Electronic Academic Papers for Scholars

Table of Links

- Introduction/Abstract

- The Blockchain

- Vulnerability of Revenue-Free Bubbles

- Success in Wrong Places

- Principles for a Currency

- The Difficult with Inflation Hedges

- Some Additional Fallacies

- Conclusion and References

PRINCIPLES FOR A CURRENCY

First, let’s discuss the demonetization of gold. In 1971, the U.S. government terminated the Bretton Woods Agreement, ending the convertibility of the U.S. dollar into gold. Gold stocks were growing too slowly, and, as mentioned earlier, much of it went to jewelry and industry — the most robust theory is that there was not enough gold to keep up with economic growth[10]. Furthermore, there had been long debates over the hampering of monetary policy by sticking to metals, as witnessed by the bullionist controversy[11]. It appears that developed economies have trouble hooking their currencies to a commodity.

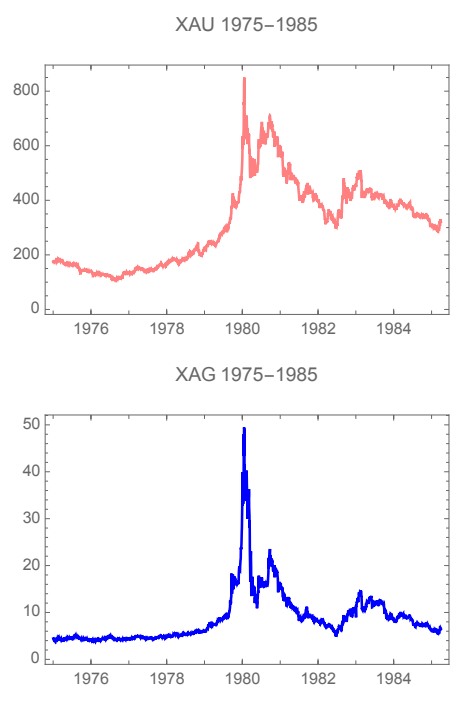

\ In the early 1970s, the Hunt brothers started to hoard silver (when they started, U.S. citizens were banned from directly owning gold), and accelerated their hoarding in the late 1970s, turning it into a squeeze. It lead to a speculative explosion in the price of silver, as shown in Fig 3, leading by contagion to

\

\ between a fivefold and tenfold increase in the price of precious metals. Then, upon the deflation of the bubble, metals gave back more than half of their gains and languished for more than two decades. At the time of writing, 41 years later, neither gold nor silver have, inflation adjusted, reached their previous peak. The same effect took place in 2008-2009 in the wake of the banking crisis: gold and silver jumped upwards between 80 and 120 % then subsequently lost most of their gains.

\ Gold and silver proved then that they could neither be a reliable numeraire, nor an inflation hedge. The world had become too sophisticated for precious metals. If we consider the most effective numeraire, it must be the one in which the bulk of salaries are paid, as we will show next.

\

\ Let us go deeper into how a currency can come about. No transaction between two persons is analytically pairwise in an open economy. The root of the confusion lies in the prevalent naïve-libertarian illusion that a transaction between two consenting adults, when devoid of coercion, is effectively just a transaction between two consenting adults and can be isolated and discussed as such[12]. But one must consider the ensemble of transactions and the interactions between agents: people happen to engage in contractual agreements with others; for them a specific transaction is just one piece. To be able to regularly buy goods denominated in bitcoin (whose prices fixed in bitcoin but floating in U.S.$ or some other fiat currency), one must have an income that is fixed in bitcoin. Such an income must come from somewhere, say, an employer. For an employer to pay a salary fixed in bitcoin, she or he must be getting revenues fixed in bitcoin. Furthermore, for the vendor to offer a can of beer in fixed bitcoins, she or he must be paying for the raw material, and have the overhead fixed in bitcoin. The same applies to the mismatch of assets and obligations on a balance sheet. All this requires a parity in bitcoin-USD of low enough volatility to be tolerable and for variations to remain inconsequential.

\ There are also arbitrage bounds present in any sufficiently efficient economy with relatively free markets.

\ Furthermore, if a vendor prices goods in bitcoin, and the value fluctuates from the initial fixing, the price will be directly or indirectly arbitraged: when the conversion rate to fiat is favorable, customers will buy from the bitcoiner; when it is unfavorable they will either buy elsewhere (indirect arbitrage), or if possible, return previously purchased goods (direct arbitrage). For the price to not be arbitrageable requires the good to be unique and unavailable elsewhere at a price fixed in another currency –in this case it becomes, simply, a proxy for bitcoin. The only items that currently appear to be somewhat priced in bitcoin are other cryptocurrencies, even then not always.

\ Bimetalism did not last long [11], nor could commodities last as currencies in developed economies[12].

\ More generally, the reasons multiple currencies exist (in the absence of pegs) is because there is not enough globalization and markets are not entirely free between currency zones. And some goods and services, "such as haircuts and auto repair cannot be traded internationally" [13] ; they are not, to use the language of quantitative finance, arbitrageable.

\ In 2021, the governments (central and local) share of GDP in Western economies is around 30-60%, one order of magnitude higher than it was in the 1900s. Government employees and contractors get paid in fiat currency; taxes are collected similarly[13].

\ Finally, while within a modern currency zone a bimetallic style dual currency cannot easily exist, the same limitations exist between currency zones; parity between currencies tend to be subjected to volatility bounds. An observation we currency option traders made while doing cross-currency volatility arbitrages is that the volatility of a currency pair is inversely proportional to the trade between the two currency zones — countries heavy into trade such as Hong Kong, Saudi Arabia, the UAE, and Singapore (at some point) have maintained explicit pegs to the U.S. dollar or some basket. There could be an interactive relationship between trade and volatility: one can argue that the stability of a currency-pair (adjusted for the yield curve) encourages trade and trade in turn brings stability to the pair[14],[15].

\ Now bitcoin, as seen in Fig.1 has maintained extremely high volatility throughout its life (between 60% and 100% annualized) and, what is worse, at higher prices, which makes it’s capitalization considerably more volatile, rising in price as shown in Fig. 2 — is it too volatile to fail?

\

THE DIFFICULTY WITH INFLATION HEDGES

This does not mean that a cryptocurrency cannot displace fiat –it is indeed desirable to have at least one real currency without a government. But the new currency just needs to be more appealing as a store of value by tracking a weighted basket of goods and services with minimum error.

\ Displacing fiat is not easy, and has been done locally — though no single item has proved to be permanent and the difficulty is best represented in the following example. During the 1970s, the Italian national telephone tokens, the gettoni, were considered acceptable tender, almost always accepted as payment. The price of the espresso when expressed in lira varied over time, but it remained sticky to the gettone. For a while the gettone proved the closest money to track the Fisher Index across 12 communes[16]16. And while the gettoni worked for daily purchases such as espresso, it is doubtful that they could have been used as payment for an Alfa Romeo [18].

\ Considering that communications get cheaper over time, the notion of a telephone call is today, in the Zoom days, obsolete. So the gettone story illustrates the fact that, owing to technological changes, in the long term, no single item, such a telephone call, will permanently track inflation indices and act as a store of value. Even categories have their weights naturally revised over time: the share of food and clothing declined by almost threefold as a proportion of Western consumers expenditure since the great recession.

\ Thus we can look at an inflation hedge as the analog of a minimum variance numeraire.

\

\ Can one find her or his own hedge?

\ In the parable of the Christ in the temple, Jesus kicked the money changers out of the temple of Jerusalem… Now one wonders why were there were money changers in a place of worship? The answer is that the temple took for currency only the shekel of Tyre, known for its 90% silver content and its ancestral quality control [19][17].

\ Simply, there is a free market for fiat currencies, with the most reliable at the time used by third parties. Before the Euro, there were plenty of currencies in Europe. But long term contracts, investments, and commitments were evaluated in deutschmarks or Swiss francs, sometimes the U.S. dollar; drachmas, liras, and pesetas were there mostly for petty expenditures. So what we had was competition between fiat currencies just as with the shekel-of-Tyre!

\ This competition provides for a vastly more convenient monetary store of value. For practitioners of quant finance, the most effective inflation hedge can be a combination of bets which includes the short bond.

\

:::info Author:

(1) Nassim Nicholas Taleb, Universa Investments, Tandon School of Engineering, New York University Forthcoming, Quantitative Finance.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

[10] Ironically the U.S. deficit caused the dollar to be more widely available and used, in stable supply, by what is called the Triffin paradox.

\ [11] Even Ricardo got drawn in, see Ricardo’s 1811-1816 arguments [8],[9], and commentary by Jevons [10].

\ [12] www.libertarianism.org

\ [13] The designation "fiat" is a misleading stretch of language: money is not created by edict but largely via credit, by governments or the private sectors, particularly the banking system — and both lenders and borrowers need the least volatile currency [14].

\ [14] Currency pairs often show fake volatility as the spot price can be fluctuating, but forward contracts do less so, owing to interest rate adjustments in the weak currency: interest rates rise to compensate holders for the devaluation.

\ [15] We note here that quantitative finance operates along the lines of neoclassical economic theory in that both share a central principle: absence of arbitrage, which maps to the law of one price — the former, a concept initially aimed at goods and services, may be broadened to include asset valuation [15]. When we apply the law of one price to currencies, we realize using basic arbitrage arguments that the recent globalization does not allow for different currencies to coexist in the same marke: one must win.

\ [16] Likewise, the M-Pesa mobile currency used as tender in Africa is associated with transferable airtime minutes [17]. People can do microfinance via cell phones.

This content originally appeared on HackerNoon and was authored by EScholar: Electronic Academic Papers for Scholars

EScholar: Electronic Academic Papers for Scholars | Sciencx (2025-08-26T21:01:47+00:00) The Limits of Inflation Hedges: Gold, Silver, Bitcoin, and Beyond. Retrieved from https://www.scien.cx/2025/08/26/the-limits-of-inflation-hedges-gold-silver-bitcoin-and-beyond/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.